WHO IS REQUIRED TO SUBMIT FINANCIAL REPORTING?

All holders of a Direct Delivery Authorization are required to submit financial reporting and make any applicable payments to LCBO on a regular basis. This includes a NIL report if you have not made any sales.

You must complete all requirements as set out in your LCBO Authorization to be considered in good standing and remain in the program.

To streamline reporting requirements, this process is also used for the Ontario Deposit Return Program and other reporting that is required for holders of an AGCO Manufacturer’s Licence (wineries and distilleries only).

WHEN AM I REQUIRED TO SUBMIT MY REPORTS AND PAYMENTS?

The reporting period is monthly and the report and remittance must be received by the 20th day of the next month. To ensure your payment is accurate, please see the amount for “Total LCBO Payment” within the Remittance Summary of the reporting template.

Some manufacturers may be eligible for quarterly reporting and payments. To be eligible, the manufacturer must be in good standing and its total remittances be less than $100,000 in the preceding calendar year.

HOW DO I SUBMIT MONTHLY V. QUARTERLY REPORTS?

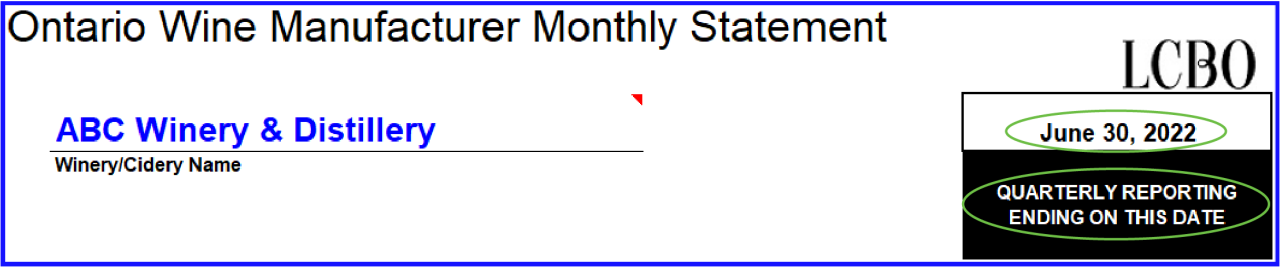

Step #1: Populate Manufacturer Name from the Winery/Cidery/Distillery Name Drop-Down List

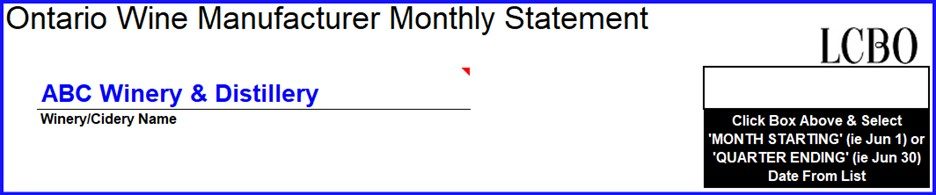

Step #2: Populate either the Monthly or Quarterly Reporting Date from the Date Drop-Down List

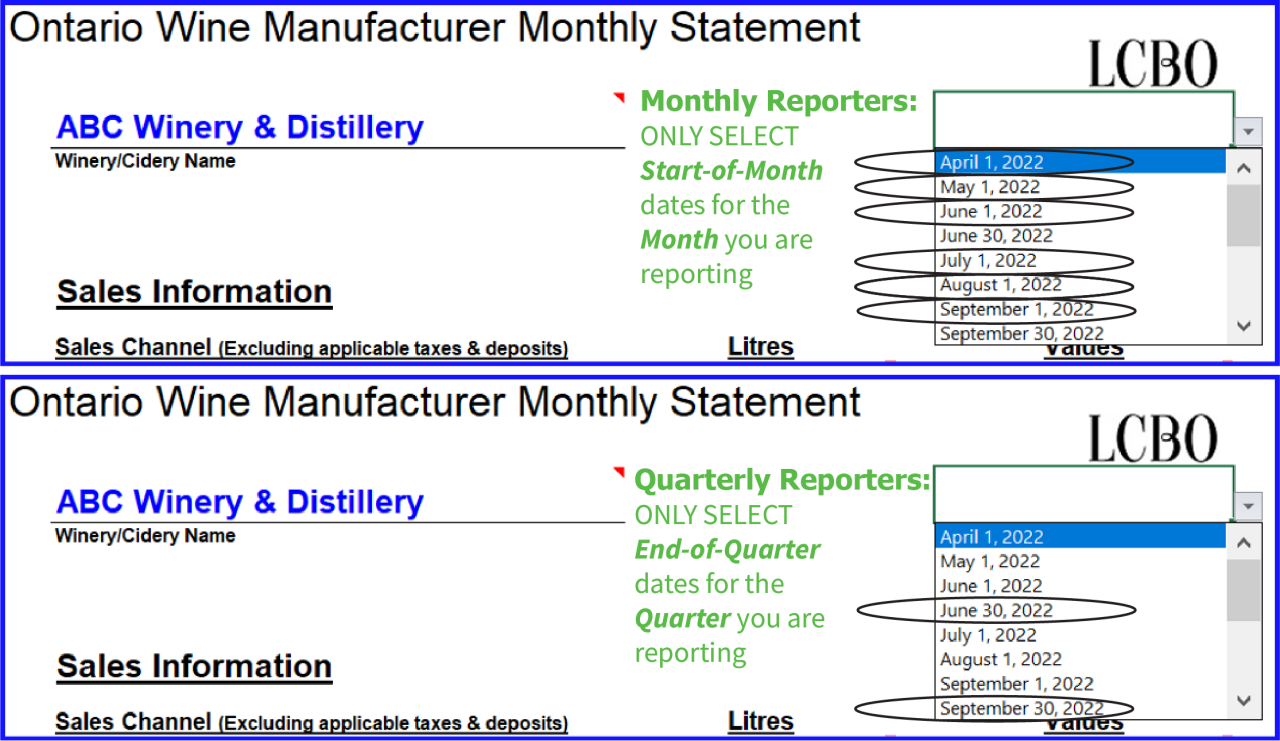

Step #3: Review Selected Date and Below Updated Reporting Statement for Accuracy

HOW DO I SUBMIT THE COMPLETED REPORTS?

Reports must be in Excel format and submitted by email to distilleryreporting@lcbo.com and/or winery.reporting@lcbo.com.

Please note that quarterly reports must be within a single template. Three separate monthly reports will not be accepted.

HOW DO I SUBMIT MY PAYMENTS?

Reports must be submitted prior to or on the same day as your payment. To learn more about the payment process, please email accounts.receivables@lcbo.com.

HOW CAN I OPT IN FOR QUARTERLY REPORTING AND PAYMENTS?

New Applicants: Manufacturers applying for a Direct Delivery Authorization may apply to opt-in for quarterly reporting and payments as part of their application process.

Authorized Manufacturers: Once participating in the Direct Delivery Program, manufacturers may opt-in for quarterly reporting and payments at the beginning of each LCBO fiscal year, April, if they have total remittances less than $100,000 in the preceding calendar year. Only manufacturers surpassing the $100,000 threshold will be notified.

Note: Eligible manufacturers can report either monthly or quarterly for sales starting in April. The reporting frequency must remain consistent for the entire LCBO fiscal year (April to March).

WHAT HAPPENS IF I DO NOT MEET MY OBLIGATIONS?

If you do not submit your reports and payments on time, you may be subject to penalties for late payments. The LCBO may also suspend or revoke your authorization, which will impact your ability to participate in the program.

QUESTIONS?

For questions related to winery reporting, please email winery.reporting@lcbo.com.

For questions related to distillery reporting, please email distilleryreporting@lcbo.com.

For questions regarding payments, please email accounts.receivables@lcbo.com.

Ontario Wine Appellation Authority (OWAA) - Formerly known as 'VQA Ontario'

For wineries reporting sales of VQA Wine to the Ontario Wine Appellation Authority (OWAA), please

note the remaining requirement to report the ‘VQA 3003 - VQA Wine Sales Report – All Channels’ form monthly, by extracting the form from the LCBO Winery Reporting Template, or by submitting the whole template, using the Appellation Authority online portal. More information can be obtained on the Appellation Authority website or by contacting them directly at info@vqaontario.ca.